$SOWG - A Potential Freeze-Dried Candy Giant in the Making

~4x forward earnings for a rapidly growing CPG company

Summary:

Sow Good is a sweet and candy company operating in one of the fastest growing categories in the consumable packaged goods market: freeze-dried foods. It went public via a reverse merger in 2020 led by two entrepreneurs, Ira and Claudia Goldfarb who saw potential in the underinvested freeze-dried food/snack industry and initially began selling fruits, smoothies, and meals, but wisely pivoted into the freeze-dried candy industry in March 2022. Since then, revenues have risen over 1000% due to category growth and social media trends. However, despite market dominance in a growing category and a potential 400%+ revenue growth for FY24 with potential for significant growth thereafter, the stock still trades for ~4x my estimates for FY24.

Company:

Ticker: $SOWG

Price: USD $7.50

Market Cap: $45.2M

Net Debt: 9M

Sow Good manufactures and sells freeze dried sweets, candies, and other consumables via retailers, distributors, and a DTC website with presence in nearly 6,000 retail locations as of November. As of December 31st, 63% of sales come from retailers, 34% from wholesale, and the rest from e-commerce. They are the only company to be sold nationwide in a variety of retailers including Target, Five Below, Mom and Pop candy stores, and convenience stores. Since shifting to primarily selling freeze dried candy, they generated revenues of 1.3M, 5M, and an estimated 9.5M in Q2, Q3, and Q4 respectively representing growth rates in the 5-10x range. This growth will moderate, but I think revenue will skyrocket from FY23 to FY24 for a few reasons.

First, many of the above retailers have room for SKU expansion and further store rollout since sales have outpaced projections in current locations. Sow Good has only 18 SKUs and has indicated interest in significantly increasing that number, having already expanded from just 9 SKUs in Q1. There is clearly demand for additional products seeing that Five Below more than doubled SKUs per store from 2 to 5 this year alone. Also, they are only available in a fraction of stores for many retail partners, presenting additional upside as they continue rollout. Combined with the roll out of other major retailers including Circle K which launched recently and Kroger which launches in Q124, shelf space is nearly certain to increase in FY24.

Next, their main constraint is production capacity with management claiming they have been completely sold out in previous quarters. This will be solved in Q1 and Q2 as additional freeze driers are built, and co-manufacturing agreements come into play. Management further mentioned that they are constructing a second freeze drying facility in New Mexico but provided no completion date.

Lastly, general market growth will boost sales. Freeze dried sweets are completely new, and if market growth continues, Sow Good will benefit from industry tailwinds.

Market:

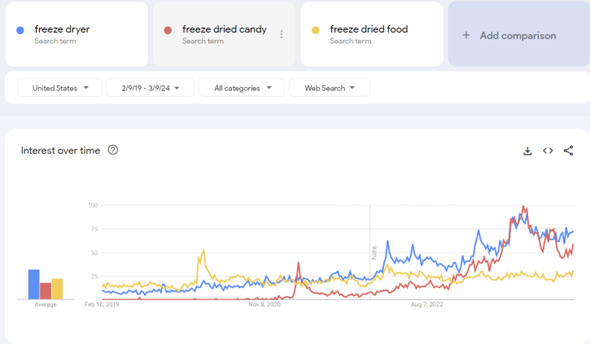

Freeze-drying a product removes all moisture and results in extended shelf life, unique texture, and changed shape. It’s been a concept used by manufacturers for decades in other food categories as well as the iconic astronaut ice cream, but the technology only recently became accessible to consumers. Harvest Right's affordable in-home freeze-drier, launched in 2013, sparked a growing DIY trend. This exploded during the pandemic, and candy's viral appeal on social media became a major market driver. While some dismiss freeze-dried candy as a short-lived fad originated from TikTok, I don’t think that’s the case.

While social media was undoubtedly a driver of growth in this category, every time the trend went viral, demand stabilized and returned to growth shortly thereafter.

Furthermore, I spoke to ~10 different sellers of freeze-dried candy including retailers, mom and pop candy store owners, and freeze-dried candy business owners along the Northeast. Notably, in all cases, freeze dried candy was still generating strong sales in many stores with prime shelf space and expanding SKUs. Not only that, the smaller, local wholesalers noted that sales had accelerated since the recent TikTok trend as word-of-mouth spreads and people make repeat purchases. It’s yet to be seen if it can penetrate the mainstream retailers like Kroger, Walmart, and Target in the long run, but here are 3 reasons why I think it can.

· Teeth and dental work: Many vendors said that some of their biggest clients were dentists and orthodontists since FDC does not stick to the teeth, and those protective of their teeth or those with dental work can enjoy classic candies stress free. Not only that, kids with braces could also eat certain freeze-dried candies.

· Production Flexibility: You can freeze dry most candies, allowing manufacturers to shift production to the trendiest candies at a low cost.

· Content Appeal: The candy is great for content creators and marketing. The change in shape and crunch makes it prime content for ASMR and satisfying videos “satisfying” category for social media.

Ultimately, I believe that the category will continue to grow as it becomes more mainstream and broadens to include even more sweets.

Competition:

While the consumer-packaged goods market for sweets and candy is highly competitive with many large-scale operators, Sow Good is by far the largest freeze-dried candy producer with all its competitors being mom and pop stores or pure ecommerce plays with negligible wholesale operations. With Sow Good’s scale, it undercuts the prices of most of its competitors and with its distribution, customers can buy it at their Target, Five Below, or soon their Kroger. This is important because many potential customers see a bag of freeze-dried candy on their TikTok, YouTube, or Instagram feed, but are unwilling to purchase it at an unaffordable price. However, those same customers may be willing to pay $5 when they’re impulse shopping. Additionally, the ability to touch and feel the candy is what sells customers on FDC the most, so the widespread in store presence is essential to success. Thus, the competitors contribute to general industry growth through marketing with Sow Good being the largest benefactor.

Catalysts:

Currently, they are constrained by 3 freeze driers that can produce a maximum of $35M of product but recently completed another one in Q124 and are expected to complete an additional 2 in Q224 enabling $75M in production capacity. Coupled with the co-manufacturing agreements signed near the end of FY23, Sow Good could easily generate ~$13M in Q124 and >$75M in FY24. Considering that they have constantly been out of stock, I expect this supply to be absorbed. With sales at least doubling, net income should more than double, and the stock should appreciate significantly. Additionally, any equity raises at higher valuations or an uplisting could push the stock higher.

Management:

This company is founder-led by Ira and Claudia Goldfarb, two serial entrepreneurs. These two have a history in the freeze-dried industry dating back over 10 years to when they started Prairie Dog Pet Products: a freeze-dried pet snack company that reached roughly $50M in revenue and was later sold to private equity. They have over a decade of experience in the freeze-dried industry which led them to be the first movers for freeze dried desserts. Additionally, they have significant skin in the game controlling over 90% of the stock alongside the board and having most of their compensation vested in stock options. Notably, their recent compensation package involved nearly 2 million shares at strike prices of $9.75 and $40 per share, so they are heavily incentivized to increase the stock price and liquidity. Their new compensation package has revenue targets of $75M and $18.75M in EBITDA targets, with roughly 50% growth rates thereafter.

Price target:

Management provided little guidance and the industry could fluctuate significantly over the next year, but they have mentioned that they are operating at capacity and plan to reach 75M in capacity for FY24. We’ll assume they reach their revenue target for FY24, which is also their maximum expected capacity. Even at a far smaller scale than FY24, gross margins were 46% Q323 following the shift into candy. Assuming a large increase in headcount salaries and constant gross margin due to co manufacturing agreements offsetting scale benefits, we arrive at a 28% EBITDA margin with EBITDA of ~21M on 75M of revenue. With 8 million shares fully diluted and no preferred stock, $SOWG currently trades at a conservative ~4x forward P/E and ~2.2x EV/EBITDA based on my estimates. Established CPG companies traditionally trade for 15-20x forward EV/EBITDA with far lower growth rates, but also far lower risk. Applying a conservatives 10x EV/EBITDA multiply implies upside of around 300%, accounting for dilution of an additional 2M shares, and realistically the company could trade much higher if it successfully executes on its expansion initiatives and the freeze-dried industry continues its growth trend.

Risks:

Fading Trend: If freeze dried candy proves to be a fad, capacity will expand into shrinking demand. The company would be left with idle freezers and excess inventory, resulting in slowing sales growth and lower margins. Retailers would likely drop Sow Good, and sales would plummet even further. Again, I don’t think this is the case, but the risk is there.

Competition: Competition from an established brand would threaten Sow Good’s position since its products are essentially freeze-dried versions of popular candies, so if those candies released their own versions of freeze-dried candy, sales would undoubtedly plummet. This is unlikely soon however as the industry is still very new, and building capacity would take 1-2 years.

Corporate Governance: Sow Good is a family founded company with the board and executives controlling over 90% of voting shares, so they could grow hostile towards minority shareholders. They hired their daughter as a director fresh out of college and have numerous related transactions which raises further concerns. Most worrying is the fact that the CFO left after 3 months without reason. However, the company recently relocated to Delaware and needs liquidity and price increases for their options to go ITM, so they are likely aligned with shareholders in the near term, but I’m still wary of governance.

Conclusion:

If you believe the freeze-dried candy/sweets industry is more than just a fad, Sow Good could easily one of the best plays on the market. With a first mover’s advantage, manufacturing expertise, and strong distribution, Sow Good is undoubtedly going to be a massive winner in the freeze-dried category if it explodes, and its current illiquidity and lack of coverage is an opportunity for risk seeking investors.

Disclosure: I am long shares of $SOWG. These are my thoughts alone and should not be used as a basis for an investment decision. Not financial advice.

I read your article with interest and while reading Prospectus 424B filed by $SOWG on May 3, 2024, I noticed on page 44 that the dilutive warrants amount to approximately 50% of the company's outstanding shares. If this is correct, it means that the company's market capitalization will be 50% higher than it is now. I would appreciate your opinion if I have understood this correctly.

From Prospectus 424B4, Page 44.

Except as otherwise indicated, the discussion and the tables above assume no exercise of the underwriters’ over-allotment option to purchase additional shares of common

stock from us and that the underwriters do not purchase additional shares of common stock from us pursuant to the Representative’s Warrants.

The number of shares of our

common stock to be outstanding after this offering is based on 9,961,809 shares of our common stock outstanding as of April 25, 2024, which is comprised of:

(i) 6,029,371 shares of common stock outstanding as of December 31, 2023;

(ii) the shares issued pursuant to the 2024 PIPE;

(iii) the shares issued in connection with the Warrant Exercise Transaction;

(iv) the shares issued pursuant to the Equity Compensation Grants; and

(v) 1,200,000 shares issued in this offering at a public offering price of $10.00 per share of common stock

and excludes:

•999 shares of our common stock are issuable upon the exercise of options outstanding under the 2012 Plan as of December 31, 2023;

•2,000 shares of our common stock are issuable upon the exercise of options outstanding under the 2016 Plan as of December 31, 2023;

•2,617,814 shares of our common stock are issuable upon the exercise of options outstanding under the 2020 Plan as of December 31, 2023;

•2,291,250 shares of our common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $2.50 per share as of December 31, 2023; and

•3,000,000 shares of our common stock are reserved for future issuance under our 2024 Plan, which is now effective, as well as any automatic increases in the number of shares

of common stock reserved for future issuance under the 2024 Plan.

Great call. Would love to hear your thoughts on the stock today.