$SBBC - A good company, bad company situation

Simply Better Brands is not the company it was a year ago, and this is where the opportunity lies.

Ticker: $SBBC.V, $SBBCF

Price: $.25 (all values in USD)

Market Cap: $18.9M

Net Debt: $4.1M

Summary:

Simply Better Brands is a good company, bad company situation with a clear path to value realization. The bad: a now bankrupt, unprofitable cannabis brand that spent more in advertising last year than it made in gross profit. The good: a rapidly growing, differentiated protein bar company on track to do $45M in sales for 2024. New management made it clear that their priority is to enable their crown jewel and shed the unprofitable, non-core assets. However, despite a fast growing, profitable segment that could easily be worth >$100M, the enterprise value of the firm today sits at a mere $23M.

Company:

Simply Better Brands was a brand incubator that operated under 3 main brands and one strategy: buy sustainable brands that appeal to millennials and gen z, ramp up marketing to blow up sales, then profit. Unfortunately, after years of doing this, sales were still highly unprofitable, and the CEO stepped down in January. The company’s original core brand (a 50.1% owned subisdiary), PureKana, declared bankruptcy earlier this month, and the other unprofitable brands are soon to follow. However, amidst all the turmoil is a hidden treasure: Trubar. Trubar is a women founded, vegan protein bar that is distributed across North America. Though it was initially purchased at just $1M in revenue in 2021, it did over $30M in sales for FY23 and is on track to do $40-45M in FY24.

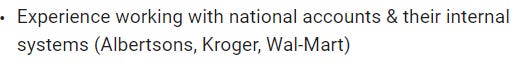

Sadly, its performance was obscured by PureKana. Despite comprising of just 50% of sales for FY23, PureKana was responsible for 70% of marketing expenses whereas Trubar represented 40% of sales, but just 16% of marketing expenses. Not only that, nearly all the customer support costs of ~4M were attributed to PureKana and other cannabis brands. These figures don’t include corporate overhead, which was likely allocated in large to PureKana. Without the deadweights, Trubar is a profitable brand that has a long runway for growth ahead.

Here's why I think Trubar is just getting started:

SKU Expansion: Despite having $30M in sales, Trubar only sells 6 different flavors of protein bars. This leaves ample room for expansion into powders, supplements, and other products in this category.

Market Positioning: Trubar is one of the few protein bar brands to market towards women. Women are hugely underserved in the protein supplements market and that leaves potential for Trubar to take full advantage of this segment, considering it’s one of the fastest growing areas of this industry.

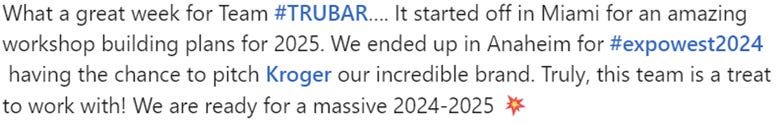

Store Rollout: Trubar only recently entered Costco and could easily penetrate Whole Foods, Sprouts, and other retailers as brand strength builds. Recent press releases support this view, including their recent rollout to Sheetz locations and strengthened relationship with Costco. Not only that, some LinkedIn posts and job listings suggest that they may be entering Kroger, Albertson’s, and Walmart as I write this pitch.

If Trubar can properly execute on these growth opportunities, they can easily surpass $100M+ in sales within 3-4 years with room for further upside.

Market and Competition:

In a fragmented industry with little differentiation, Trubar stands out as a vegan, gluten free, and women-focused brand. It’s one of the few protein brands that targets women, differentiating their brand, narrowing competition, and allowing for outsized growth rates. Combine that with its amazing marketing and you have a differentiated brand in a competitive industry.

*Side note, I’ve probably tried every protein bar at least once to figure out which ones I like, and Trubar is great for the price tag.

Catalysts:

The path to value realization has never been simpler because the current CEO is exactly who shareholders should want to run the company. J.R. Kinglsey Ward, a large shareholder, is the chairman of Clarus securities, and current interim CEO of Simply Better Brands. Let’s hear what Clarus had to say about the stock.

“Our target price of C$1.25 per share is now equal to 2x EV/2024e TRUBAR revenues,”. We view all other SBBC brands as non-core and expect them to be stabilized for breakeven cash flow (PureKana) or sold/shuttered. Given TRUBAR’s spectacular growth rate over the past few years and the pipeline of new U.S. retail distribution, we expect SBBC to focus working capital and corporate mindshare on maximizing TRUBAR’s growth.”

Management’s comments on the recent shuttering of PureKana further supports this view.

“The special committee and our Board of Directors undertook a comprehensive review of PureKana’s business and concluded that the business model, given the significant costs associated with acquiring and retaining customers, does not fit with SBBC’s strategy for profitable growth,” said SBBC Interim CEO J.R. Kingsley Ward. “The decision of previous management to continue investing in high-cost affiliate marketing programs in the CBD market did not meet our objectives for growth and profitability. As a result, SBBC can no longer support PureKana’s operations and continued investment in PureKana is not considered to be in the best interests of SBBC and our shareholders.”

Once management breaks down the financials of the individual Trubar segment and closes remaining noncore assets, I expect the stock to rally, because investors will finally see Trubar for what it is. SBBC never broke down financials, likely to hide the losses of PureKana, so this will completely rewrite the narrative around the company. In the long run, I expect Trubar to be acquired in the next 1-2 years once management ramps up revenues and explores a sale.

Balance Sheet:

As of Q3, they had $17.4M in debt with $3.3M in cash. However, they expect to shed $10M in debt from the PureKana bankruptcy and lose only $1M in receivables. Applying this to the Q3 balance sheet leaves us with a net debt of $4.1M. These numbers are months old, so debt is likely higher today. Regardless, they should be cash flow positive this year and management mentioned that they have “adequate resources to execute the profitable growth strategy going forward”.

*Additionally, they have ~$37M in NOLs, but some may be wiped out by Purekana.

Price Target:

Since the financials haven’t been broken down per segment by the company, I scoured press releases and presentations to build a partial income statement and filled in the blanks with estimates. The basis for this model was a recent press release where management guided towards $40-45M in revenue for FY24 with 45% gross margins. With these numbers, normalized FY24 EBIT for Trubar was $4.3M with reasonable estimates.

A larger but comparable firm, Barbell Brands, trades at a valuation of 26x forward EBIT which would imply a valuation of ~105M today, despite SBBC having higher growth rates.

In terms of acquisition value, for smaller firms, acquisitions usually happen from 2-3x sales, but in a more optimistic world where they can continue growth to $75M by 2025 and $100M by 2026, Trubar would command a higher multiple in the 3-4x range, implying a valuation of $300-400M.

In either case, the current valuation of ~$24M is ridiculously low for Trubar, leaving potential for significant upside.

Risks:

Dilution: There’s significant dilution from SBC at these levels. Even though SBC is expected to be only 2M this year, that’s nearly 10 million shares. Also, there are 14M warrants with strikes at .33/share. Lastly, an equity raise at this valuation would also destroy upside, although it’s highly unlikely that management would dilute themselves unnecessarily.

Customer Concentration: Costco constitutes the majority of Trubar’s revenues. If they can’t match Costco’s required sales volume, they would lose shelf space and access to the Costco MVM. Notably, they seem to be entering Kroger, Albertson’s, BJ’s, and Sheetz amongst other retailers, so this risk should decline as they continue to expand into new storefronts.

Bias and Miscalculation: I am vegetarian and eat these protein bars. I enjoy them so I am biased. Also, I had to estimate certain financial values since management did not break down costs and revenues by segment. Moreover, this was my first time reading IFRS, so I could have made mistakes.

Conclusion:

Good company, bad company is no longer an accurate description for $SBBC since PureKana is bankrupt. Simply Better Brands is no longer the company it was a year ago, but now a profitable, growing, and underfollowed firm with room for massive upside if they can grow Trubar to its full potential.

Disclosure: I am long shares of $SBBCF. These are my thoughts alone and should not be used as a basis for an investment decision. Not financial advice.