$CURI is Quietly Inflecting

AI Licensing deals should boost earnings to highs, but no one is watching

Company: Curiosity Stream

Ticker: $CURI

Price: $2.19

Market Cap: $121.5M

EV: $60M

Summary:

Curiosity Stream operates a documentary streaming platform of owned and licensed content. An ambitious IPO valuation led to shares plummeting 80% over the last 3 years, but management corrected course through significant cost-cutting and restructuring. Today, the company is growing profitably with $40M of net cash, and last week, the company announced AI dataset licensing deals that should nearly double NTM earnings. However, despite the narrative change, shares are priced as if the company is soon to liquidate at just 2.5x forward cash flow and estimates are projecting 10% revenue growth versus management expectations of 30-40%. As the market digests the incoming inflection in earnings, I believe shares could trade closer to 8x cash flow in a base case, presenting 123% upside.

Company:

Curiosity Stream operates as one of the largest documentary streaming platforms in the country and generates revenue through a direct to consumer streaming platform, licensing content, bundling, and advertising.

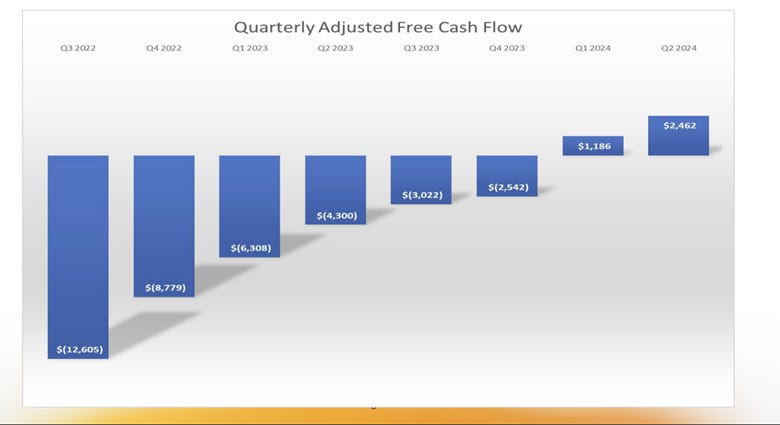

They went public in peak SPAC mania 2021 at an astounding 8x P/S multiple, but shares plummeted shortly thereafter when investors realized that subscriber growth was driven by unsustainable content spend, discounting, and excessive marketing. From 2021 to 2023, sales were down nearly 30% and shares quickly plummeted to well below net cash as investors began to price the company for bankruptcy. Management began focusing on profitability by reducing overhead, lowering content/marketing expenditure, nearly doubling subscription prices, and abandoning unprofitable partnerships. By March, the company was approaching breakeven and at the end of FY 2023, they posted adjusted EBITDA of -$20.2 versus -$44.3M for 2022. However, despite an extremely ugly income statement, EBITDA and net income were negatively impacted by excessive amortization of legacy content assets, despite maintenance content spend resting at a fraction of the amortization line item. Thus, adjusted cash flow (which will eventually equate to net income) has painted a completely different story.

Furthermore, the business has continued to improve in 2024 as new growth initiatives are showing early signs of success and cost cutting continues. Despite revenues in the first 9 months being down 12.2%, the direct-to-consumer business, which constitutes >70% of sales, has risen double digits YoY with improved margins. The revenue decline is primarily from the discontinuation of unprofitable bundle revenue and a decline in the lumpy licensing business. Note that during this same time, G&A and marketing are down >20% YoY resulting in adjusted free cash flow reaching records levels of $2.6M in Q32024. Based on the midpoint of management’s guidance for Q424, annualized cash flow sits at roughly $10M, but I believe Curiosity Stream is poised to double this number for 2025.

Here’s why:

1. AI Demand

Curiosity Stream has long discussed licensing their 300,000 hours of footage to hyperscalers for training purposes, but now the promises are becoming a reality. Last week at a conference, the CEO said that hyperscaler licensing deals are expected to land in 2025 and that the licensing business would be more than half the direct-to-consumer revenue (per an 8-K that was filed shortly after), which today stands at ~$40M. That implies that licensing revenue will increase from $5M to $20M+ next year, which will incrementally increase profits by $7.5M at minimum. Considering they’re layering this over the next several quarters, it’s likely that 2026 numbers are even better as we see the full, annualized impact of the licensing agreements. Management expects this to continue for multiple years, which is supported by other media companies who have sold their content in multi-year deals (e.g. Shutterstock and OpenAI signing a 6-year deal).

2. Signs of inflection in Streaming

Curiosity generates almost 80% of revenue through its direct business which is divided between partner subscription where a user subscribes to Curiosity Stream at a premium via Amazon/Roku/Youtube TV and direct subscription where a user subscribes directly to Curiosity Stream at a lower price point. Curiosity hiked prices by ~80% roughly 2 years ago causing significant churn in subscriber base, but recently we have begun to see signs of stability with direct subscription revenue down only ~ 4% YTD. More importantly, for the first time in 3 years domestic web traffic has been relatively flat YoY for 3 months and web traffic for their premium offering Curiosity University (~2x the price) has steadily accelerated throughout the year indicating successful upselling efforts

Furthermore, the slight decline has all been more than offset by partner subscription significantly growing through subscriber growth throughout the last year from 13.7% of sales in 2023 to ~20%. Management has stated that this will be a continued vehicle of growth and that they plan to roll out to additional platforms given its success. We could be seeing the early signs of a turnaround in the direct subscription business, and if web traffic converts to revenue stabilizing, the core business could see double digit growth entering 2025 from upselling + partner direct sales.

3. Incremental Revenue from Advertising

Management has recently announced their expansion into free ad-supported streaming television (FAST) through partners and that should slightly boost sales entering 2025. While they weren’t material this year having only launched in late summer/early fall, they launched at a global scale very recently and the results should kick in as early as Q1 for next year. The market is roughly 1/10th the size of regular streaming, but if they could command the same share as they do in streaming, FAST would generate $4M in revenue and generate free marketing for the direct business.

4. Continued cost-cutting

Even after reducing costs significantly for 2024, management suggested they can further reduce costs in 2025 and that investors can look to gross margins expanding. Furthermore, as amortization expense drifts closer to content spend, I expect the company to post positive EBITDA next year considering the company should post near breakeven numbers for Q4. Assuming they can continue to grow topline, these cost cuts should flow directly to the bottom line and generate an additional ~1M-2M in net income for FY25

Market and Competition:

Curiosity Stream operates in the streaming industry, which is highly competitive, but they’ve carved a niche in the documentary space as the largest provider. Although the industry dynamics do not favor them, as players like Netflix, Disney Plus, and Amazon continue to hike prices, CURI is a reasonable alternative at $3-$8/mo for anyone who enjoys documentaries. With the decline in traditional media, pricing increases from competitors, niche position, and international expansion, I believe CURI will stabilize or grow at a slow pace over the next few years. Ultimately, considering the industry has been consolidating, I expect CURI to be an acquisition target and management will hopefully sell before things deteriorate significantly.

Catalysts:

Revenue trends stabilizing and ultimately flipping to growth as we progress through 1H25 will allow the market to capitalize EBITDA. I expect we’ll get more color on Q4 earnings when management speaks to this cadence as well as provides more concrete guidance the opportunity presented by hyperscaler licensing deals. At this point, investors will hopefully realize that analyst estimates of $55M in sales for FY25 are far too low and rerate equity accordingly.

Alternatively, management has pointed to a dividend increase which could serve as another catalyst. This ended up happening today.

Price Target:

I’m forecasting DTC revenue to be slightly up, although it’s more likely we will see larger growth based on web traffic stabilizing and partner direct revenue subscriber growth. Gross margin is diluted by AI revenue which should fall closer to 50% due to revenue sharing agreements from licensed content versus 90%+ margin revenue on other content which I’m projecting to expand to 92%. SG&A should be relatively flattish with a potential slight decline due to continued cost-cutting and efficiencies. Content spend is assumed to be in line with 2024 at $4M. Note that adjusted EBITDA doesn’t back out content spend, and adjusted FCF accounts for maintenance content spend. Normalized net income accounts for $4M (note that this was elevated for FY24 due to the stock quadrupling) and interest income of $2M. We arrive at $26.2M of cash flow and $22.2M of normalized earnings.

Note that since the company has significant NOLs, I’ve converted adjusted cash flow to normalized net income and COGS reflects annual content spend, NOT historical amortizations of legacy content.

CURI has a $121.5M market cap, $40M in net cash, $300M in accumulated losses, and investments in Nebula and Spielberg that could be worth $20-40M. Since the investments are uncertain, we’ll discount them appropriately and set EV to $60M.

With these projections, we arrive at a normalized P/E of ~5.5x and an EV/FCF of <2.5x. I believe the company should trade closer to 8x EV/FCF based on comps in a base case. Thus, my price target is 8x 2025 FCF or $4.89 per share, representing 123% upside from today’s prices. However, if the DTC business can continue 10% growth for FY25, we could see a bull case price target of $7.57 reflecting 12x FCF of $29.9M and 245% upside. For a downside case, the current low valuation, net cash position, and attractiveness as an acquisition target make it difficult to see below $1.50 or a 4x P/E.

Management and Shareholders:

Management includes the chairman/founder who owns >40% of the stock and the CEO who owns 4%. The founder formerly founded the Discovery channel which was then acquired by paramount. All the executives and board members have heavy experience in the media industry and are qualified to hold their seats.

Risks:

Failure to close Hyperscaler Deals: While management disclosed that they expect 15M+ in AI related data for 2025, there is a chance that these deals fall through. Especially in light of the recent news around Deepseek, hyperscaler capex spend could be affected. Management seems undisturbed going off of today’s PR.

Failed Acquisition: Management has indicated that they would buy content/competitors at the right valuation, and M&A usually fails in microland. However, given management’s ownership and experience with M&A during their time at Discovery, I don’t think it’s a thesis breaker.

Decline in Core Business: The DTC business could perform more poorly than expected which would significantly hamper profits.

Conclusion:

Curiosity Stream is a hidden AI beneficiary on verge of inflection which will be further fueled by improvements in its core business. Despite the ~400% rally over the last year, shares still remain extremely cheap and I expect the narrative to shift significantly over the next years as investors digest the turnaround.

Subscribe if you liked the writeup, and as always, feel free to reach out with comments/questions/concerns.

Disclaimer:

I own shares. This post reflects my own thoughts only and should not be used as a basis for your own financial decisions. I am not a registered financial advisor and this is not financial advice.

Is Curi a buy here?

Great analysis!